What Does Kam Financial & Realty, Inc. Do?

What Does Kam Financial & Realty, Inc. Do?

Blog Article

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide to Kam Financial & Realty, Inc.The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking AboutThe 6-Minute Rule for Kam Financial & Realty, Inc.The Only Guide for Kam Financial & Realty, Inc.Some Known Factual Statements About Kam Financial & Realty, Inc. Kam Financial & Realty, Inc. for Beginners

When one considers that mortgage brokers are not needed to file SARs, the actual volume of home mortgage fraud task could be a lot higher. (https://profiles.delphiforums.com/n/pfx/profile.aspx?webtag=dfpprofile000&userId=1891242010). As of early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending mortgage scams examinations,4 compared to 818 and 721, respectively, in both previous yearsThe mass of mortgage fraudulence drops right into 2 broad classifications based on the motivation behind the fraudulence. normally entails a customer who will certainly overstate revenue or property values on his/her financial declaration to get a financing to buy a home (mortgage broker in california). In a number of these situations, assumptions are that if the income does not climb to fulfill the settlement, the home will certainly be cost a benefit from gratitude

Some Ideas on Kam Financial & Realty, Inc. You Should Know

The huge bulk of fraudulence circumstances are discovered and reported by the organizations themselves. Broker-facilitated scams can be scams for property, fraud for profit, or a combination of both.

The complying with stands for a case of fraudulence commercial. A $165 million area bank decided to enter the mortgage banking company. The bank bought a little mortgage business and employed a seasoned home loan banker to run the operation. Almost five years right into the relationship, a financier informed the bank that numerous loansall came from with the same third-party brokerwere being returned for repurchase.

Getting My Kam Financial & Realty, Inc. To Work

The financial institution informed its key federal regulator, which after that contacted the FDIC since of the possible effect on the bank's monetary problem ((https://www.metooo.io/u/kamfnnclr1ty). Additional investigation revealed that the broker was operating in collusion with a contractor and an appraiser to flip residential properties over and over once again for higher, illegitimate earnings. In overall, more than 100 car loans were come from to one contractor in the same subdivision

The broker rejected to make the repayments, and the situation went into lawsuits. The financial institution was eventually granted $3.5 million. In a succeeding discussion with FDIC examiners, the financial institution's president suggested that he had actually constantly heard that one of the most hard part of mortgage banking was making certain you applied the ideal hedge to counter any type of rate of interest run the risk of the bank could incur while warehousing a significant quantity of home loan.

Things about Kam Financial & Realty, Inc.

The financial institution had representation and guarantee conditions in contracts with its brokers and believed it had option with regard to the car loans being come from and sold with the pipe. Throughout the litigation, the third-party broker suggested that the bank must share some responsibility for this exposure since its interior control systems must have identified a funding focus to this set community and set up measures to discourage this danger.

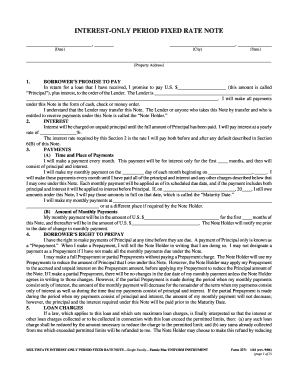

To get a better grip on what the heck you're paying, why you're paying it, and for how long, let's damage down a normal month-to-month mortgage repayment. Do not be fooled below. What we call a monthly mortgage settlement isn't simply repaying your home mortgage. Rather, think about a month-to-month mortgage payment as the 4 horsemen: Principal, Passion, Residential Or Commercial Property Tax, and Property owner's Insurance (called PITIlike pity, because, you know, it raises your settlement).

However hang onif you think principal is the only quantity to think about, you would certainly be forgeting principal's buddy: passion. It 'd behave to believe lenders allow you obtain their money even if they like you. While that might be real, they're still site link running a company and wish to put food on the table as well.

The Buzz on Kam Financial & Realty, Inc.

Interest is a percentage of the principalthe amount of the financing you have left to pay back. Rate of interest is a percent of the principalthe quantity of the lending you have left to pay back. Home loan rates of interest are constantly changing, which is why it's smart to choose a home loan with a fixed rates of interest so you understand exactly how much you'll pay monthly.

That would mean you would certainly pay a massive $533 on your initial month's home loan settlement. Prepare for a bit of mathematics here. Do not worryit's not complex! Using our home loan calculator with the instance of a 15-year fixed-rate home mortgage of $160,000 once more, the complete rate of interest cost mores than $53,000.

Some Ideas on Kam Financial & Realty, Inc. You Need To Know

That would certainly make your monthly home mortgage payment $1,184 monthly. Month-to-month Principal $1,184 $533 $651 The next month, you'll pay the exact same $1,184, yet less will certainly most likely to interest ($531) and a lot more will certainly go to your principal ($653). That pattern proceeds over the life of your mortgage until, by the end of your home loan, almost all of your payment goes towards principal.

Report this page